With 94% of total retail sales, traditional retail spaces aren’t going anywhere anytime soon. But disruptions from ecommerce and new technologies combined with changing consumer demands continue to shape how retailers are selling.

Here are some of the dynamic and unexpected ways that technology and evolving consumer tastes will shape retail spaces.

Fewer Shelves, More Showrooms

When Steve Jobs severed ties with major big box retailers to regain control of Apple’s product presentation, many thought he was mad. However, the fruits of his labor helped set a new paradigm in retail spaces when Apple began opening stores in 2001. Eschewing typical retail sensibilities, Apple hid away nearly all of their product stock from the public eye so that clean, elegant and non-distracting displays are the central focus.

These ideals are being modified using digital technology so that shopping becomes less of a process of picking up goods and more of an experience. Adidas has used this approach to create interactive window displays that customers use to learn more about products.

With these dynamic, colorful touch screens, customers can peruse product lines, choose different shoe colors and learn more about product features, even after the retail location closed. These interactions also served as sales lead generation since users could save their order using a quick QR code capture so that it could be picked up in the store or shipped later. Adidas reported that a quarter of these customers entered a retail store, and 90% of passers-by stopped and watched when someone was interacting with the display.

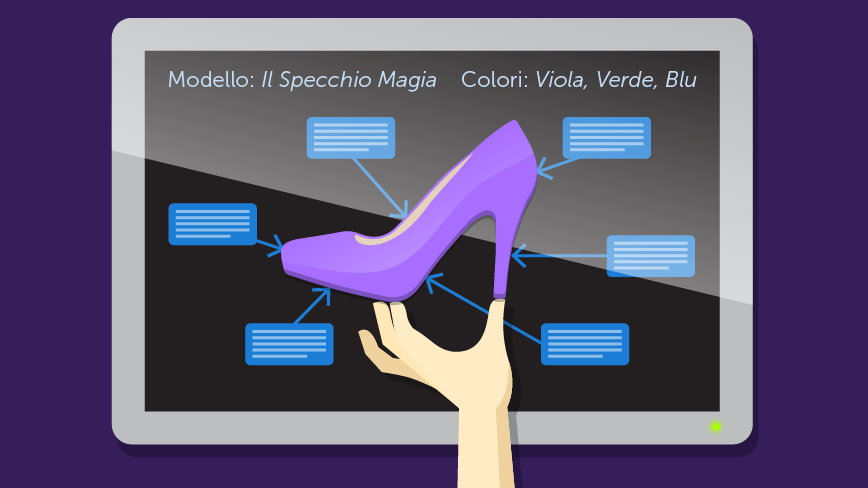

Other brands like Burberry have been using similar technology so that in-store customers could hold items up to a “magic mirror,” which would reveal product details such as how the item was made along with suggestions for complementary products in their line. Altered reality displays have also been used to change the color of the item the customer was wearing or even “try on” glasses or makeup without ever touching a real product. Brands are using these approaches not just to get customers excited about unique, technology-enabled experiences, but also to educate about products so that consumers can make more informed decisions.

Better Supply Chains Through Data

Supply chains are also evolving so that physical retail stores can match the expansive capabilities of those online. Stores that allow customers to peruse in-store stock online and order items through ship-to-store have been pioneers in this movement. Online navigation allows users to eliminate frustrating store browsing experiences where they are poring over shelves to see if they missed something or if their particular product was indeed not stocked.

As this type of “bricks and clicks” approach evolves, storefronts will become more akin to educational experiences instead of places to “grab it and go.” Predictive analytics will help retailers determine the optimal mix of products to stock, while product requests can be honored through quick shipping. Stores like Best Buy have utilized this strategy by creating a network of store inventory so that larger hub stores can keep stock of items customers may want but that have less demand and warehouses can flesh out the deeper requests that are not worth cluttering store aisles.

These capabilities are usually enabled by third-party logistics and data companies who can track inventory on a granular level while analyzing the “big picture” of what items and prices will drive the most sales. Online and offline purchases alike drive key insights as to the most effective inventory levels, which can vary enormously from market to market.

Marketing will also likely change to reflect these incremental differences in regional preference. A home goods store chain in Boise, Idaho, might stock and advertise linens as the major component of their business model, whereas another store in Chicago might emphasize their kitchen ware. These strategies will be informed by key data insights that analyze consumer interest profiles throughout the region and predict where key revenue drivers could come from, telling stores which items to display most prominently in which locale.

Faced with competition from an online retail market that is growing by double digits, physical retail spaces are feeling more and more pressure to adopt strategies like these so that customers can feel engaged and get the instant gratification they have come to expect when entering a store. All the while, data and technology such as beacons, altered reality and interactive digital signage will help draw people into the unique experiences retail brands can offer.