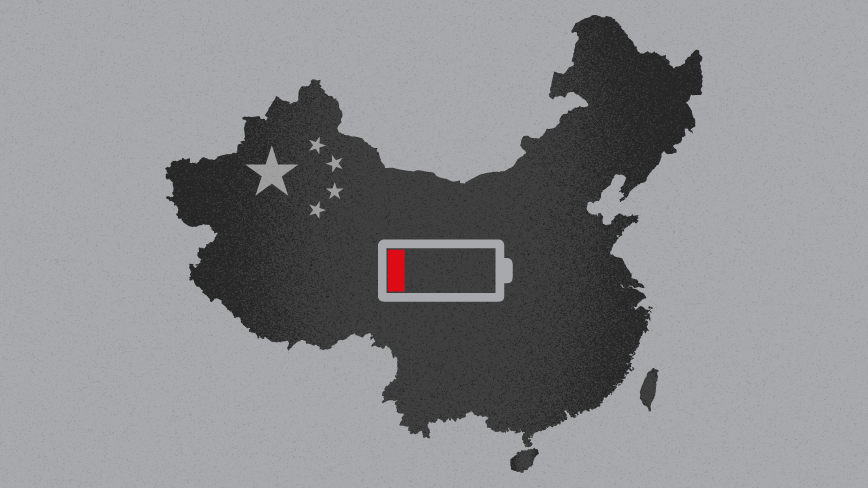

After a breakneck period of growth, China’s economy and the markets that fuel it have been experiencing some jarring contractions.

For digital marketing, the current emphasis on mobile channels like China’s popular WeChat will likely have to evolve. More precise targeting of individuals who still have a taste for imported goods, especially luxury ones, will help brands shore up their shrinking market as China delves further into uncertain territory in 2016.

Beijing’s Economy

More than a year of slowing growth and an unusually strong U.S. dollar put the official Chinese currency, the yuan, at a disadvantage, which hurt Chinese exporters. In an attempt to correct this, the government-run People’s Bank cut the value of the yuan. This move aimed to bring it back into balance with currencies in other developing countries.

At least, that was the goal. Instead of bringing the desired stability, concerns over economic slowdown and volatile currency prompted additional selloffs of Chinese stocks, sending markets plunging. The Chinese government’s mechanism for shutting down trading early in the event of selloffs — commonly referred to as a “circuit breaker” — kicked in on January 7 after only 29 minutes of trading.

While few world players have direct stakes in Chinese trading, the uncertain state of the Chinese economy sent aftershocks into other markets. In the U.S., the Dow and S&P 500 both fell in the first trading days of 2016, leading to the worst four days of a New Year.

Fueling this bearish market are concerns from investors who owned previously lucrative stocks in luxury brands that have grown in popularity with the Chinese middle class. For example, Coach credited 14 percent of its growth in 2015 to Chinese consumers. With the currency devaluation, luxury goods are now more expensive, which has led some to fear luxury brand revenue will decline.

The sky is far from falling, though. “This is not a situation that should result in panic; it should result in caution,” Kristina Hooper, head of U.S. investment strategies at Allianz Global Investors, told the Associated Press.

Many American investors and companies are bracing for changes ahead, even if they are not quite sure what they might be.

How Brands Can Keep Their Composure

The growing Chinese middle class has been “maturing” in terms of its purchasing power, something they have been putting to good use. Tom Doctoroff of Fast Company writes, “On an emotional level, there is a sense that there are certain essential rites of passage to middle-class status, such as homes, diamond rings, education, and car ownership.” This appetite may now be suppressed, forcing once-energized brands to look for deeper opportunities in China and abroad that could make up for the shrinking revenue potential.

One method they could turn to is appealing to the qualities that drive luxury purchases here in the States. Our survey of U.S. affluents found that the qualities that drive “status” purchases in developing markets like China — exclusiveness, celebrity endorsements, trending popularity — are all secondary to the qualities that make luxury items desirable in the first place. Namely: craftsmanship, design artistry and after-sales service. These positive attributes mean that a luxury good is an actual investment in long-lasting quality rather than a frivolous purchase. If digital marketers double down on emphasizing values like these, they could see a ballasting effect even as the Chinese market gets choppy.

In spite of this potential foothold, only one thing is certain: 2016 will be an interesting year, and savvy marketers may have to adjust plans according to how things play out.